The world's top ten optical transmission equipment manufacturers are all developing optical devices

- Categories:Industry News

- Time of issue:2022-06-15

(Summary description) Dell'Oro analyst Jimmy Yu recently shared his latest analysis on the competitive landscape of global optical transmission equipment suppliers 25G SFP-DD PON OLT. By most measures, the optical transmission market is very healthy. Market revenues are just over $15bn and have grown by an average of 5% a year since 2003, the worst year for optical transmission. If you look at WDM systems alone, the sector is growing at an annual rate of 12%. The optical transmission equipment industry does not have the highest profit margins of any industry, but neither does it have the lowest 25G SFP-DD PON OLT. Here are the analysts' most interesting findings about the vendor landscape: 1. There are 23 major suppliers in the world actively selling optical systems. Nine are based in North America, seven in Europe/Middle East, six in Asia Pacific and one in Latin America. 2. Of the 23 suppliers, 10 develop some optical devices either internally or through sister companies (subsidiaries or part of enterprise groups). 3. The 10 optical device development suppliers are also among the top 10 in the optical transmission industry, with a combined market share of 97%. 4. Of the top 10 suppliers, 5 compete on technology. That said, five companies have invested more in R&D to develop the latest coherent DSPS and photonics with a view to being the first to bring the latest coherent wavelength technology to market. 5. The five suppliers competing in technology have a combined market share of 70%. What's more, these five companies account for 90% of the faster growing 400+Gbps wavelength shipments and 90% of the business related to Internet content providers. Thus, while there are 23 optical system suppliers in the industry, they are located in different parts of the world and have a certain advantage when selling to local customers. Moreover, 10 of the 23 suppliers have the vast majority of the market, with half vying for technological leadership 25G SFP-DD PON OLT. What about the 13 suppliers vying for a 3 per cent market share? Each of them will say they are pushing for the full $15 billion. However, given that 70% of the market is held by technology leaders, analysts put the SAM(available services market) of these 13 vendors at close to $4 billion 25G SFP-DD PON OLT. Second, these companies are not all the same. Some companies are poised to take some market share, while others are just hanging on or getting close to exiting. The remaining 13 companies are evaluated as follows: four are growing, four are stable and five remain stagnant. This means that, in practice, the number of optical transmission providers competing could be closer to 18 a year 25G SFP-DD PON OLT. Finally, Jimmy Yu says the number of suppliers was closer to 30 when he first evaluated them a decade ago. It took 10 years to go from 30 to 23. Perhaps, in another decade, there will be fewer than 20 suppliers 25G SFP-DD PON OLT.

The world's top ten optical transmission equipment manufacturers are all developing optical devices

(Summary description) Dell'Oro analyst Jimmy Yu recently shared his latest analysis on the competitive landscape of global optical transmission equipment suppliers 25G SFP-DD PON OLT.

By most measures, the optical transmission market is very healthy. Market revenues are just over $15bn and have grown by an average of 5% a year since 2003, the worst year for optical transmission. If you look at WDM systems alone, the sector is growing at an annual rate of 12%. The optical transmission equipment industry does not have the highest profit margins of any industry, but neither does it have the lowest 25G SFP-DD PON OLT.

Here are the analysts' most interesting findings about the vendor landscape:

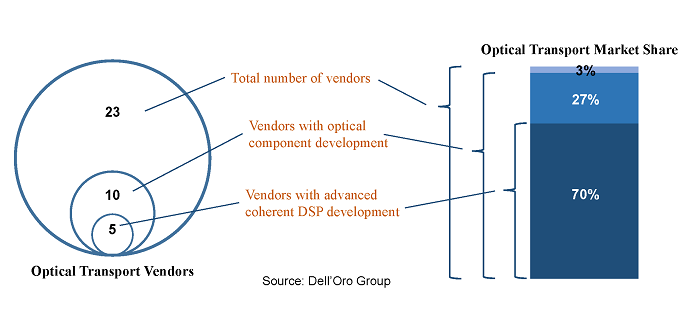

1. There are 23 major suppliers in the world actively selling optical systems. Nine are based in North America, seven in Europe/Middle East, six in Asia Pacific and one in Latin America.

2. Of the 23 suppliers, 10 develop some optical devices either internally or through sister companies (subsidiaries or part of enterprise groups).

3. The 10 optical device development suppliers are also among the top 10 in the optical transmission industry, with a combined market share of 97%.

4. Of the top 10 suppliers, 5 compete on technology. That said, five companies have invested more in R&D to develop the latest coherent DSPS and photonics with a view to being the first to bring the latest coherent wavelength technology to market.

5. The five suppliers competing in technology have a combined market share of 70%. What's more, these five companies account for 90% of the faster growing 400+Gbps wavelength shipments and 90% of the business related to Internet content providers.

Thus, while there are 23 optical system suppliers in the industry, they are located in different parts of the world and have a certain advantage when selling to local customers. Moreover, 10 of the 23 suppliers have the vast majority of the market, with half vying for technological leadership 25G SFP-DD PON OLT.

What about the 13 suppliers vying for a 3 per cent market share? Each of them will say they are pushing for the full $15 billion. However, given that 70% of the market is held by technology leaders, analysts put the SAM(available services market) of these 13 vendors at close to $4 billion 25G SFP-DD PON OLT.

Second, these companies are not all the same. Some companies are poised to take some market share, while others are just hanging on or getting close to exiting. The remaining 13 companies are evaluated as follows: four are growing, four are stable and five remain stagnant. This means that, in practice, the number of optical transmission providers competing could be closer to 18 a year 25G SFP-DD PON OLT.

Finally, Jimmy Yu says the number of suppliers was closer to 30 when he first evaluated them a decade ago. It took 10 years to go from 30 to 23. Perhaps, in another decade, there will be fewer than 20 suppliers 25G SFP-DD PON OLT.

- Categories:Industry News

- Time of issue:2022-06-15

- Views:

Dell'Oro analyst Jimmy Yu recently shared his latest analysis on the competitive landscape of global optical transmission equipment suppliers 25G SFP-DD PON OLT.

By most measures, the optical transmission market is very healthy. Market revenues are just over $15bn and have grown by an average of 5% a year since 2003, the worst year for optical transmission. If you look at WDM systems alone, the sector is growing at an annual rate of 12%. The optical transmission equipment industry does not have the highest profit margins of any industry, but neither does it have the lowest 25G SFP-DD PON OLT.

Here are the analysts' most interesting findings about the vendor landscape:

1. There are 23 major suppliers in the world actively selling optical systems. Nine are based in North America, seven in Europe/Middle East, six in Asia Pacific and one in Latin America.

2. Of the 23 suppliers, 10 develop some optical devices either internally or through sister companies (subsidiaries or part of enterprise groups).

3. The 10 optical device development suppliers are also among the top 10 in the optical transmission industry, with a combined market share of 97%.

4. Of the top 10 suppliers, 5 compete on technology. That said, five companies have invested more in R&D to develop the latest coherent DSPS and photonics with a view to being the first to bring the latest coherent wavelength technology to market.

5. The five suppliers competing in technology have a combined market share of 70%. What's more, these five companies account for 90% of the faster growing 400+Gbps wavelength shipments and 90% of the business related to Internet content providers.

Thus, while there are 23 optical system suppliers in the industry, they are located in different parts of the world and have a certain advantage when selling to local customers. Moreover, 10 of the 23 suppliers have the vast majority of the market, with half vying for technological leadership 25G SFP-DD PON OLT.

What about the 13 suppliers vying for a 3 per cent market share? Each of them will say they are pushing for the full $15 billion. However, given that 70% of the market is held by technology leaders, analysts put the SAM(available services market) of these 13 vendors at close to $4 billion 25G SFP-DD PON OLT.

Second, these companies are not all the same. Some companies are poised to take some market share, while others are just hanging on or getting close to exiting. The remaining 13 companies are evaluated as follows: four are growing, four are stable and five remain stagnant. This means that, in practice, the number of optical transmission providers competing could be closer to 18 a year 25G SFP-DD PON OLT.

Finally, Jimmy Yu says the number of suppliers was closer to 30 when he first evaluated them a decade ago. It took 10 years to go from 30 to 23. Perhaps, in another decade, there will be fewer than 20 suppliers 25G SFP-DD PON OLT.

Scan the QR code to read on your phone

Related

-

New products | Sunstar announced: 50G PON three-mode combo OLT miniaturized optical device for SFP and QSFP packages

With the popularization of gigabit broadband, 10G PON has entered the stage of large-scale deployment. At the same time, the industry is also laying out 50G PON to prepare for the 10-gigabit era. Compared with 10G PON, the 50G PON standard provides five times more access bandwidth and better service support capabilities (large bandwidth, low latency, and high reliability). At the same time, for operators, the biggest problem facing the commercial use of 50G PON is the problem of multi-generation coexistence. ITU-T standards provide different options for the differentiated deployment of global operators. GPON region, G.9804.1 Amd2 and G.9805 offer 2 classes /5 options; EPON area, provides 2 types /4 options. From this point of view, multi-generation coexistence is an inevitable choice in the continuous evolution of the next generation PON. Sunstar Communication Technology Co.,Ltd.released 50G PON three-mode Combo OLT miniaturized optical device, which is MPM (built-in combined wave) 3-generation wave division mode coexistence, that is, G/XG(S)/50G three-mode MPM. The advantage of this solution is that the traditional gateway devices can be reused without changing or upgrading the user side, and the upgrade process can be optimized, equipment occupation and equipment room space can be saved, and energy consumption can be reduced. This three-mode Combo OLT miniaturized optical device uses a novel optical path design and a miniaturized TO-CAN package solution, and uses the technology accumulation and quality control of Sunstar Company in the field of coaxial packaging for many years, combining precision manufacturing, multi-wavelength spectrographic design and various types of TO-CAN package technology perfectly together. The 50G PON three-mode Combo OLT compact optical device of Sunstar Company is characterized by small size, high coupling efficiency, high structural reliability and strong manufacturability in mass production. The most critical is that its optimized optical path design and special packaging process ensure the upstream three-wavelength splitting, especially the isolation index of 50G PON upstream wavelength and GPON upstream wavelength, that is, the isolation degree of 1286±2nm and 1310±20nm edge wavelength; And take into account the high coupling efficiency of the downgoing three-way emitting laser to ensure the best output optical power index. This optical device is fully suitable for SFP and QSFP module packages, helping the access network to smoothly evolve to 50G PON. The 49th Optical Networking and Communications Symposium and Expo (OFC 2024) will be held from March 26 to 28, 2024 at the San Diego Convention Center, California, USA. The company will bring 10G PON OLT, 25G PON OLT, 50G PON OLT three-mode, 400G ER4 TOSA & ROSA, 800G DR8 optical module and a full range of AOC optical module solutions to the exhibition, welcome to visit the #3841 booth. About Sunstar Founded in 2001, Sunstar Communication Technology Co.,Ltd. focuses on the design, development, manufacturing, sales and technical support services of Optical Transceiver (OSA). After 20 years of technology accumulation and development, the formation of optical path, mechanical structure, high frequency simulation, thermal simulation, circuit, FPC soft board, IT software automation and other core technology design platform, and with precision machining, passive components, SMT, TO-CAN, OSA optical devices, COB, BOX, optical module the whole industry chain production and manufacturing capabilities. The company operates in China, North America, Europe, and Southeast Asia, and is also a subsidiary of the world's leading provider of optical fiber, cable and integrated solutions,YOFC Optical Fiber and Cable Co., LTD. - OFC2024 | Sunstar sincerely invites you to visit #3841 for negotiation and guidance 03-22

- Sunstar Combo 50G & XGS & GPON OLT QSFP-DD light module won the 2023 ICC "Excellent Technology Award" 01-10

- Tel:86-(0)28-87988088

- Fax:86-(0)28-87988568

- Address:4F.,Blog.D1,Mould lndustrial Park West High-tech Zone,Chengdu,Sichuan,P.R.C

Sunstar Communication Technology Co.,Ltd

Copyright © 2020 Sunstar Communication Technology Co.,Ltd All Rights Reserved 蜀ICP备19023203号-1

Scan code

Scan code