Yole: The CPO market will generate $2.6 billion in revenue in 2033

- Categories:Industry News

- Time of issue:2023-03-30

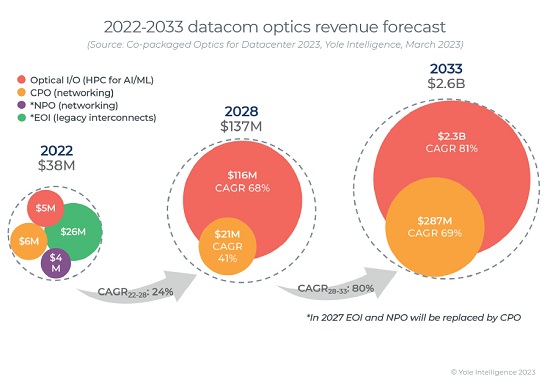

(Summary description)Yole reports that revenue generated by the CPO market reached approximately $38 million in 2022 and is expected to reach $2.6 billion in 2033, with a compound annual growth rate of 46% in 2022-2033. Projections for the rapidly growing size of Training dataset suggest that data will be a major bottleneck for expanding ML models, so we may see a slowdown in the progress of artificial intelligence (AI). Using optical input/output (I/O) in ML hardware can help overcome this bottleneck. This bottleneck is the main driving factor for the adoption of optical interconnection in the next generation of high performance computing (HPC) systems. Co-packaged optical devices have attracted much attention in high performance computing For the past 50 years, mobile technology has emerged every decade. Mobile bandwidth requirements have evolved from voice calls and text messages to ultra-high definition (UHD) video and various augmented reality/virtual reality (AR/VR) applications. While the COVID-19 pandemic has had a profound impact on the telecommunications infrastructure supply chain, consumers and business users around the world continue to generate new demand for web and cloud services. Social networking, business conferencing, ultra HD video streaming, e-commerce and gaming apps will continue to drive growth. The number of devices connected to the Internet in every home and every person is increasing. With the advent of new digital devices with ever-increasing capabilities and intelligence, the adoption rate of users is increasing every year. In addition, expanding machine-to-machine applications, such as smart meters, video surveillance, healthcare monitoring, networked drives and automated logistics, are greatly contributing to the growth of devices and connectivity, and driving the expansion of data center infrastructure. The co-packaged optical device (CPO) market faces difficult times due to service provider budget cuts and the fact that pluggable devices can already deliver the cost savings and low power consumption promised by CPOs. Full deployment of CPOs will only happen when pluggable devices lose momentum. It will be difficult for CPOs to compete with pluggable modules for at least the next two generations of switch systems, as pluggable modules will remain preferred for a long time. Cpos have received a lot of attention recently due to their network power efficiency in data centers (DCS). LC's analysis shows that the power savings from the network are negligible compared to the total power consumption of the data center. Only a handful of CPO vendors, such as Broadcom, Intel, Marvell, and others, will bring proprietary solutions to the market. In order to meet market demand and convince end users of the feasibility of CPOs, a multi-vendor business model and the validation of significant cost and power savings are a must. With the arrival of 6.4T optical modules by 2029 at the latest, fierce competition between CPOs and pluggable optics is likely to occur. A number of technical hurdles in the CPO system are expected to be resolved by this time. However, the transceiver industry is constantly innovating to drive the market for pluggable optics. Until CPO systems are mass-shipped for network applications, pluggable co-packaging approaches will be adopted, and optical engines will become increasingly popular in high-performance computing and decomposed future systems. The industry ecosystem, which includes Ayar Labs, Intel, Ranovus, Lightmatter, AMD, GlobalFoundries, and others around machine learning (ML) system vendors Nvidia and HPE, has made considerable progress, It plans to deliver the products in bulk between 2024 and 2026. Yole reports that revenue generated by the CPO market reached approximately $38 million in 2022 and is expected to reach $2.6 billion in 2033, with a compound annual growth rate of 46% in 2022-2033. Projections for the rapidly growing size of Training dataset suggest that data will be a major bottleneck for expanding ML models, so we may see a slowdown in the progress of artificial intelligence (AI). Using optical input/output (I/O) in ML hardware can help overcome this bottleneck. This bottleneck is the main driving factor for the adoption of optical interconnection in the next generation of high performance computing (HPC) systems. Photonic integrated circuits make CPOs with low power and low cost optical interconnection possible Yole expects 800G and 1.6T pluggable modules to be very popular because they take advantage of 100G and 200G single-wavelength optics and therefore can be technically and cost-effectively implemented in QSFP-DD and OSFP-XD packages. Pluggable packages will be limited in their ability to support 6.4T and 12.8 capacities in terms of required electrical and optical density, thermal management and energy efficiency. Due to the use of discrete electrical devices, power consumption and thermal management are becoming the limiting factors for pluggable

Yole: The CPO market will generate $2.6 billion in revenue in 2033

(Summary description)Yole reports that revenue generated by the CPO market reached approximately $38 million in 2022 and is expected to reach $2.6 billion in 2033, with a compound annual growth rate of 46% in 2022-2033. Projections for the rapidly growing size of Training dataset suggest that data will be a major bottleneck for expanding ML models, so we may see a slowdown in the progress of artificial intelligence (AI). Using optical input/output (I/O) in ML hardware can help overcome this bottleneck. This bottleneck is the main driving factor for the adoption of optical interconnection in the next generation of high performance computing (HPC) systems.

Co-packaged optical devices have attracted much attention in high performance computing

For the past 50 years, mobile technology has emerged every decade. Mobile bandwidth requirements have evolved from voice calls and text messages to ultra-high definition (UHD) video and various augmented reality/virtual reality (AR/VR) applications. While the COVID-19 pandemic has had a profound impact on the telecommunications infrastructure supply chain, consumers and business users around the world continue to generate new demand for web and cloud services. Social networking, business conferencing, ultra HD video streaming, e-commerce and gaming apps will continue to drive growth.

The number of devices connected to the Internet in every home and every person is increasing. With the advent of new digital devices with ever-increasing capabilities and intelligence, the adoption rate of users is increasing every year. In addition, expanding machine-to-machine applications, such as smart meters, video surveillance, healthcare monitoring, networked drives and automated logistics, are greatly contributing to the growth of devices and connectivity, and driving the expansion of data center infrastructure.

The co-packaged optical device (CPO) market faces difficult times due to service provider budget cuts and the fact that pluggable devices can already deliver the cost savings and low power consumption promised by CPOs. Full deployment of CPOs will only happen when pluggable devices lose momentum. It will be difficult for CPOs to compete with pluggable modules for at least the next two generations of switch systems, as pluggable modules will remain preferred for a long time. Cpos have received a lot of attention recently due to their network power efficiency in data centers (DCS). LC's analysis shows that the power savings from the network are negligible compared to the total power consumption of the data center. Only a handful of CPO vendors, such as Broadcom, Intel, Marvell, and others, will bring proprietary solutions to the market. In order to meet market demand and convince end users of the feasibility of CPOs, a multi-vendor business model and the validation of significant cost and power savings are a must.

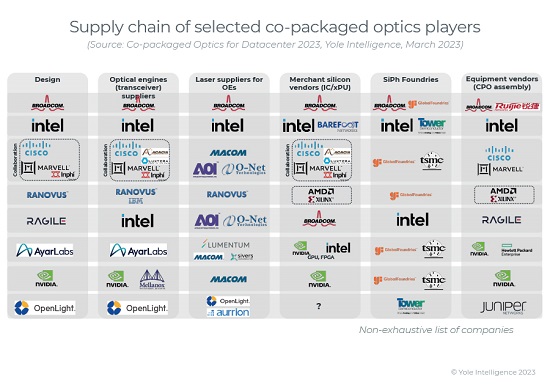

With the arrival of 6.4T optical modules by 2029 at the latest, fierce competition between CPOs and pluggable optics is likely to occur. A number of technical hurdles in the CPO system are expected to be resolved by this time. However, the transceiver industry is constantly innovating to drive the market for pluggable optics. Until CPO systems are mass-shipped for network applications, pluggable co-packaging approaches will be adopted, and optical engines will become increasingly popular in high-performance computing and decomposed future systems. The industry ecosystem, which includes Ayar Labs, Intel, Ranovus, Lightmatter, AMD, GlobalFoundries, and others around machine learning (ML) system vendors Nvidia and HPE, has made considerable progress, It plans to deliver the products in bulk between 2024 and 2026.

Yole reports that revenue generated by the CPO market reached approximately $38 million in 2022 and is expected to reach $2.6 billion in 2033, with a compound annual growth rate of 46% in 2022-2033. Projections for the rapidly growing size of Training dataset suggest that data will be a major bottleneck for expanding ML models, so we may see a slowdown in the progress of artificial intelligence (AI). Using optical input/output (I/O) in ML hardware can help overcome this bottleneck. This bottleneck is the main driving factor for the adoption of optical interconnection in the next generation of high performance computing (HPC) systems.

Photonic integrated circuits make CPOs with low power and low cost optical interconnection possible

Yole expects 800G and 1.6T pluggable modules to be very popular because they take advantage of 100G and 200G single-wavelength optics and therefore can be technically and cost-effectively implemented in QSFP-DD and OSFP-XD packages. Pluggable packages will be limited in their ability to support 6.4T and 12.8 capacities in terms of required electrical and optical density, thermal management and energy efficiency. Due to the use of discrete electrical devices, power consumption and thermal management are becoming the limiting factors for pluggable

- Categories:Industry News

- Time of issue:2023-03-30

- Views:

Yole reports that revenue generated by the CPO market reached approximately $38 million in 2022 and is expected to reach $2.6 billion in 2033, with a compound annual growth rate of 46% in 2022-2033. Projections for the rapidly growing size of Training dataset suggest that data will be a major bottleneck for expanding ML models, so we may see a slowdown in the progress of artificial intelligence (AI). Using optical input/output (I/O) in ML hardware can help overcome this bottleneck. This bottleneck is the main driving factor for the adoption of optical interconnection in the next generation of high performance computing (HPC) systems 25G SFP-DD PON OLT.

Co-packaged optical devices have attracted much attention in high performance computing

For the past 50 years, mobile technology has emerged every decade. Mobile bandwidth requirements have evolved from voice calls and text messages to ultra-high definition (UHD) video and various augmented reality/virtual reality (AR/VR) applications. While the COVID-19 pandemic has had a profound impact on the telecommunications infrastructure supply chain, consumers and business users around the world continue to generate new demand for web and cloud services. Social networking, business conferencing, ultra HD video streaming, e-commerce and gaming apps will continue to drive growth.

The number of devices connected to the Internet in every home and every person is increasing. With the advent of new digital devices with ever-increasing capabilities and intelligence, the adoption rate of users is increasing every year. In addition, expanding machine-to-machine applications, such as smart meters, video surveillance, healthcare monitoring, networked drives and automated logistics, are greatly contributing to the growth of devices and connectivity, and driving the expansion of data center infrastructure 25G SFP-DD PON OLT.

The co-packaged optical device (CPO) market faces difficult times due to service provider budget cuts and the fact that pluggable devices can already deliver the cost savings and low power consumption promised by CPOs. Full deployment of CPOs will only happen when pluggable devices lose momentum. It will be difficult for CPOs to compete with pluggable modules for at least the next two generations of switch systems, as pluggable modules will remain preferred for a long time. Cpos have received a lot of attention recently due to their network power efficiency in data centers (DCS). LC's analysis shows that the power savings from the network are negligible compared to the total power consumption of the data center. Only a handful of CPO vendors, such as Broadcom, Intel, Marvell, and others, will bring proprietary solutions to the market. In order to meet market demand and convince end users of the feasibility of CPOs, a multi-vendor business model and the validation of significant cost and power savings are a must 25G SFP-DD PON OLT.

With the arrival of 6.4T optical modules by 2029 at the latest, fierce competition between CPOs and pluggable optics is likely to occur. A number of technical hurdles in the CPO system are expected to be resolved by this time. However, the transceiver industry is constantly innovating to drive the market for pluggable optics. Until CPO systems are mass-shipped for network applications, pluggable co-packaging approaches will be adopted, and optical engines will become increasingly popular in high-performance computing and decomposed future systems. The industry ecosystem, which includes Ayar Labs, Intel, Ranovus, Lightmatter, AMD, GlobalFoundries, and others around machine learning (ML) system vendors Nvidia and HPE, has made considerable progress, It plans to deliver the products in bulk between 2024 and 2026 25G SFP-DD PON OLT.

Yole reports that revenue generated by the CPO market reached approximately $38 million in 2022 and is expected to reach $2.6 billion in 2033, with a compound annual growth rate of 46% in 2022-2033. Projections for the rapidly growing size of Training dataset suggest that data will be a major bottleneck for expanding ML models, so we may see a slowdown in the progress of artificial intelligence (AI). Using optical input/output (I/O) in ML hardware can help overcome this bottleneck. This bottleneck is the main driving factor for the adoption of optical interconnection in the next generation of high performance computing (HPC) systems 25G SFP-DD PON OLT.

Photonic integrated circuits make CPOs with low power and low cost optical interconnection possible

Yole expects 800G and 1.6T pluggable modules to be very popular because they take advantage of 100G and 200G single-wavelength optics and therefore can be technically and cost-effectively implemented in QSFP-DD and OSFP-XD packages. Pluggable packages will be limited in their ability to support 6.4T and 12.8 capacities in terms of required electrical and optical density, thermal management and energy efficiency. Due to the use of discrete electrical devices, power consumption and thermal management are becoming the limiting factors for pluggable optics in the future. Co-packaging using silicon photonics technology platforms aims to overcome these challenges.

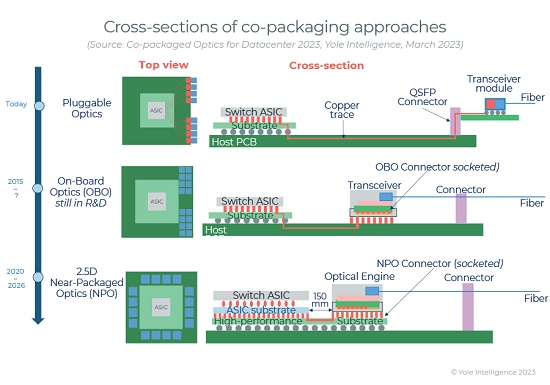

The fiber is getting closer and closer to the chipset. Using light to bring data to the point of centralized processing is one of the architect's main goals. The trend began a decade ago with proprietary designs of optical components mounted on printed circuit boards (PCBS). The Onboard Optics Alliance (COBO) continues these embedded optical interconnection (EOI) ideas and develops specifications that allow the use of onboard optical modules in the manufacture of networking devices. Cpos are an innovative approach that tightly integrates optics and ASics. With today's technology, it is challenging to surround a 50T switch chip with 16 3.2Tbps optical modules, so near Package Optics (NPO) solves this problem by using a high-performance PCB substrate (an interposer) located on the host board, while CPO uses the module to surround the chip on a multi-chip module substrate. The greater space of the NPO interposer makes it easier to route signals between chips and optical modules while still meeting signal integrity requirements. In contrast, CPO modules are closer to host ASics, allowing for lower channel losses and lower power consumption.

As technology advances, enabling communications and computing technologies to integrate more closely in business systems, networking hardware is becoming more common components. In addition, the scale of AI models is growing at an unprecedented rate, and the ability of traditional architectures (electrical interconnections based on copper) to chip to chip or board to board will be a major bottleneck in extending machine learning. Thus, for high performance computing (HPC) and its new decomposition architectures, new extremely short range optical interconnects are emerging. The decomposition design distinguishes the computing, memory, and storage components on the server card and pools them separately. Use optical-based interconnection for a variety of processing units (Xpus), especially central processing units (cpus), data processing units (Dpus), graphics processing units (Gpus), field Programmable gate arrays (FPgas) and ASics, memory and storage through advanced in-package optical I/O technology, Can help achieve the necessary transfer speed and bandwidth 25G SFP-DD PON OLT.

Data center operators will gravitate toward proven low-cost and flexible solutions

Today, the pluggable optical module market supply chain is well established. It includes discrete or integrated component suppliers, optical companies that produce transmitter and receiver optical components (TOSA and ROSA), multiplexers, digital signal processors (DSPS), and PCBS, as well as assembly/test integrators. Such a multi-vendor market model involves many different vendors. In addition, the fact that several different pluggable modules can interoperate in a single switch box also gives the industry flexibility. These are the main advantages of pluggable technologies over CPOs, which will rely heavily on silicon photonics. With the high degree of integration of optics and silicon chips, there will be a great need for new engineering capabilities and foundries, which are unacceptable for traditional medium-sized enterprises. Only multi-billion dollar optical providers can afford to switch from pluggable to CPO.

It is important to note that despite the deployment of high-end CPO solutions by mainstream (mainly large cloud operators), there are still many small enterprise data centers that have not adopted the latest interconnect technology, so the exchange rate between technologies will be slow. This means that even if CPOs become mainstream technology, pluggable modules will remain in high demand for several applications where CPOs are not technically or economically viable, such as long-distance applications and edge data centers. Yole does not expect pluggable technology to be phased out for another 10 years. However, the pluggable optics industry is likely to consolidate and the CPO market will develop a multi-vendor business model.

In 2020, the optical interconnection and switching equipment industry began intensive and extensive discussions on the further development of CPOs. Since then, several strategic collaborations have been announced and the first proof-of-concept has occurred. As evidence that the industry is taking CPOs seriously, standards bodies such as the Optical Interconnection Forum (OIF), COBO, and the Multi-Source Protocol (MSA) Organization have established internal projects to create CPO specifications. Two of the four largest cloud operators -- Meta and Microsoft -- actively support CPO penetration into their cloud networks.

Pilot testing of thousands of CPOs will begin in 2022. This year, we will see some macroeconomic headwinds, which will have a negative impact on budget-intensive projects, especially on emerging technologies such as CPOs. Recent news indicates that most major CPO supporters have suspended their support for the CPO program. Even end users are no longer paying attention to CPOs. Broadcom remains the last remaining CPO provider. Cpos have lost their appeal for several reasons. The first reason is around the pluggable mature industrial ecosystem. In addition, new optical technologies for plugable packages, including thin film lithium niobate (TFLN), Barium titanate (BTO), carbon and polymer modulators, can help achieve the required low power consumption and can be introduced to the market without changing the design of existing network systems. No matter which technology is the best in terms of performance, power, cost and manufacturability, it can flourish in the market.

The application prospects of CPO in AI/ML systems are different. The potential for billions of future optical interconnections (chip-to-chip and board-board) has prompted large foundries to prepare for mass production. Since most photonics manufacturing intellectual property (IP) is held by amorphous foundries, large foundries such as Tower Semiconductor/Intel, GlobalFoundries, ASE Group, Taiwan Semiconductor and Samsung are preparing silicon photonics processes, To accept any photonic integrated circuit (PIC) architecture from the design company. These companies have joined related industry alliances such as PCIe, CXL and UCIe. Common specifications for chipset interconnections allow the construction of large system-on-chip (SoC) packages that exceed the maximum labeled chip size. This allows mixing of components from different suppliers in the same package and increases manufacturing yield by using smaller molds. Each chipset can use different silicon manufacturing processes for specific device types or computing performance/power requirements 25G SFP-DD PON OLT.

Scan the QR code to read on your phone

Related

-

New products | Sunstar announced: 50G PON three-mode combo OLT miniaturized optical device for SFP and QSFP packages

With the popularization of gigabit broadband, 10G PON has entered the stage of large-scale deployment. At the same time, the industry is also laying out 50G PON to prepare for the 10-gigabit era. Compared with 10G PON, the 50G PON standard provides five times more access bandwidth and better service support capabilities (large bandwidth, low latency, and high reliability). At the same time, for operators, the biggest problem facing the commercial use of 50G PON is the problem of multi-generation coexistence. ITU-T standards provide different options for the differentiated deployment of global operators. GPON region, G.9804.1 Amd2 and G.9805 offer 2 classes /5 options; EPON area, provides 2 types /4 options. From this point of view, multi-generation coexistence is an inevitable choice in the continuous evolution of the next generation PON. Sunstar Communication Technology Co.,Ltd.released 50G PON three-mode Combo OLT miniaturized optical device, which is MPM (built-in combined wave) 3-generation wave division mode coexistence, that is, G/XG(S)/50G three-mode MPM. The advantage of this solution is that the traditional gateway devices can be reused without changing or upgrading the user side, and the upgrade process can be optimized, equipment occupation and equipment room space can be saved, and energy consumption can be reduced. This three-mode Combo OLT miniaturized optical device uses a novel optical path design and a miniaturized TO-CAN package solution, and uses the technology accumulation and quality control of Sunstar Company in the field of coaxial packaging for many years, combining precision manufacturing, multi-wavelength spectrographic design and various types of TO-CAN package technology perfectly together. The 50G PON three-mode Combo OLT compact optical device of Sunstar Company is characterized by small size, high coupling efficiency, high structural reliability and strong manufacturability in mass production. The most critical is that its optimized optical path design and special packaging process ensure the upstream three-wavelength splitting, especially the isolation index of 50G PON upstream wavelength and GPON upstream wavelength, that is, the isolation degree of 1286±2nm and 1310±20nm edge wavelength; And take into account the high coupling efficiency of the downgoing three-way emitting laser to ensure the best output optical power index. This optical device is fully suitable for SFP and QSFP module packages, helping the access network to smoothly evolve to 50G PON. The 49th Optical Networking and Communications Symposium and Expo (OFC 2024) will be held from March 26 to 28, 2024 at the San Diego Convention Center, California, USA. The company will bring 10G PON OLT, 25G PON OLT, 50G PON OLT three-mode, 400G ER4 TOSA & ROSA, 800G DR8 optical module and a full range of AOC optical module solutions to the exhibition, welcome to visit the #3841 booth. About Sunstar Founded in 2001, Sunstar Communication Technology Co.,Ltd. focuses on the design, development, manufacturing, sales and technical support services of Optical Transceiver (OSA). After 20 years of technology accumulation and development, the formation of optical path, mechanical structure, high frequency simulation, thermal simulation, circuit, FPC soft board, IT software automation and other core technology design platform, and with precision machining, passive components, SMT, TO-CAN, OSA optical devices, COB, BOX, optical module the whole industry chain production and manufacturing capabilities. The company operates in China, North America, Europe, and Southeast Asia, and is also a subsidiary of the world's leading provider of optical fiber, cable and integrated solutions,YOFC Optical Fiber and Cable Co., LTD. - OFC2024 | Sunstar sincerely invites you to visit #3841 for negotiation and guidance 03-22

- Sunstar Combo 50G & XGS & GPON OLT QSFP-DD light module won the 2023 ICC "Excellent Technology Award" 01-10

- Tel:86-(0)28-87988088

- Fax:86-(0)28-87988568

- Address:West District University, High-tech West Zone, Chengdu City, Sichuan Province Fourth Floor, Building D1, Chengdu Mold Industrial Park, No. 199 Road

Sunstar Communication Technology Co.,Ltd

Copyright © 2020 Sunstar Communication Technology Co.,Ltd All Rights Reserved 蜀ICP备19023203号-1

Scan code

Scan code