LC: AI clustering and HPC are the right entry point for CPO

- Categories:Industry News

- Time of issue:2022-06-07

(Summary description) The transition from plug-in Optics to co-packaged Optics (CPO) is exciting for the optical communications industry, but it is important for data centers to have realistic expectations for CPO adoption. In addition to the numerous manufacturing challenges and meeting the goal of reducing power consumption, end users must also accept CPO as a viable way to continuously reduce costs. Artificial intelligence (AI) clusters and high performance computers (HPC) have more uncertainty about the timing of CPO adoption, but this market is more willing to take risks and use innovative solutions, even if they are Proprietary. These systems require even more bandwidth than computing clusters in data centers. Experts believe that GPU interconnects can now use up to 10 times the interconnection bandwidth currently used. Disaggregated clusters need to increase about 10 times in the future. AI clusters and HPC architectures are evolving. We may see CPOs deployed on Gpus, TPus, and Ethernet, InfiniBand, or NVLink switches. There are a variety of FPGA-based accelerators that may also benefit from CPO. LC's current projections combine all of these use cases into one "AI clustering and HPC" application category. Computing clusters in large data centers will be the second largest application of CPO. Some large customers are not going to use proprietary CPO designs, preferring to wait for a new competitive ecosystem based on standard CPO solutions to emerge. This will limit the scale of early deployments, but there will be customers willing to take risks. The figure below shows LC's forecast for CPO ports and pluggable Ethernet optical transceivers and AOC shipments. Pluggable devices will continue to dominate the market for the next five years and beyond. However, CPO ports will account for nearly 30% of the total 800G and 1.6T ports deployed by 2027. CPO supporters may regard this view as too conservative, but LC suspects it may be too optimistic. Forecasters tend to underestimate how long it takes to change an industry's direction. In this analysis, LC calculates CPO based on 800G and 1.6T transceiver equivalents (or ports), but a CPO engine can combine multiple 800G or 1.6T ports into an opto-chiplet. For example, a single 3.2Tbps engine is equivalent to four 800G CPO ports. Each AOC is calculated as two ports. LC's current projections do not include shipments of Near Package Optics (NPO) developed by OIF. Meta does plan to use Npos on 51.2T switches, but these are likely to be a limited number of proof-of-concept trials. Will all CPO solutions be based on silicon Photonics (SiP) technology? Probably not. IBM is developing systems based on VCSEL. A start-up company, Avicena, is developing GaN Micro leds to enable extremely low-power, short-range (<10m) connections. More startups are still in stealth mode, and LC says it's looking forward to seeing more technology enter the fray. But at least for now, silicon light is the leader and the ultimate integration platform.

LC: AI clustering and HPC are the right entry point for CPO

(Summary description) The transition from plug-in Optics to co-packaged Optics (CPO) is exciting for the optical communications industry, but it is important for data centers to have realistic expectations for CPO adoption. In addition to the numerous manufacturing challenges and meeting the goal of reducing power consumption, end users must also accept CPO as a viable way to continuously reduce costs.

Artificial intelligence (AI) clusters and high performance computers (HPC) have more uncertainty about the timing of CPO adoption, but this market is more willing to take risks and use innovative solutions, even if they are Proprietary. These systems require even more bandwidth than computing clusters in data centers. Experts believe that GPU interconnects can now use up to 10 times the interconnection bandwidth currently used. Disaggregated clusters need to increase about 10 times in the future.

AI clusters and HPC architectures are evolving. We may see CPOs deployed on Gpus, TPus, and Ethernet, InfiniBand, or NVLink switches. There are a variety of FPGA-based accelerators that may also benefit from CPO. LC's current projections combine all of these use cases into one "AI clustering and HPC" application category.

Computing clusters in large data centers will be the second largest application of CPO. Some large customers are not going to use proprietary CPO designs, preferring to wait for a new competitive ecosystem based on standard CPO solutions to emerge. This will limit the scale of early deployments, but there will be customers willing to take risks.

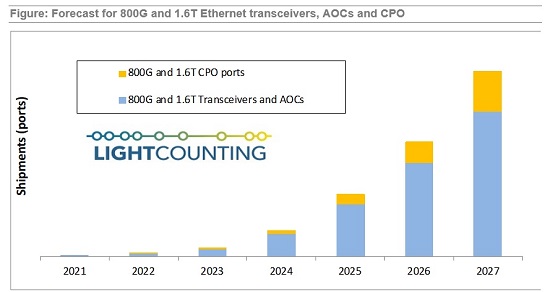

The figure below shows LC's forecast for CPO ports and pluggable Ethernet optical transceivers and AOC shipments. Pluggable devices will continue to dominate the market for the next five years and beyond. However, CPO ports will account for nearly 30% of the total 800G and 1.6T ports deployed by 2027.

CPO supporters may regard this view as too conservative, but LC suspects it may be too optimistic. Forecasters tend to underestimate how long it takes to change an industry's direction.

In this analysis, LC calculates CPO based on 800G and 1.6T transceiver equivalents (or ports), but a CPO engine can combine multiple 800G or 1.6T ports into an opto-chiplet. For example, a single 3.2Tbps engine is equivalent to four 800G CPO ports. Each AOC is calculated as two ports.

LC's current projections do not include shipments of Near Package Optics (NPO) developed by OIF. Meta does plan to use Npos on 51.2T switches, but these are likely to be a limited number of proof-of-concept trials.

Will all CPO solutions be based on silicon Photonics (SiP) technology? Probably not. IBM is developing systems based on VCSEL. A start-up company, Avicena, is developing GaN Micro leds to enable extremely low-power, short-range (<10m) connections. More startups are still in stealth mode, and LC says it's looking forward to seeing more technology enter the fray. But at least for now, silicon light is the leader and the ultimate integration platform.

- Categories:Industry News

- Time of issue:2022-06-07

- Views:

The transition from plug-in Optics to co-packaged Optics (CPO) is exciting for the optical communications industry, but it is important for data centers to have realistic expectations for CPO adoption. In addition to the numerous manufacturing challenges and meeting the goal of reducing power consumption, end users must also accept CPO as a viable way to continuously reduce costs.100G QSFP28 SR4

Artificial intelligence (AI) clusters and high performance computers (HPC) have more uncertainty about the timing of CPO adoption, but this market is more willing to take risks and use innovative solutions, even if they are Proprietary. These systems require even more bandwidth than computing clusters in data centers. Experts believe that GPU interconnects can now use up to 10 times the interconnection bandwidth currently used. Disaggregated clusters need to increase about 10 times in the future.100G QSFP28 SR4

AI clusters and HPC architectures are evolving. We may see CPOs deployed on Gpus, TPus, and Ethernet, InfiniBand, or NVLink switches. There are a variety of FPGA-based accelerators that may also benefit from CPO. LC's current projections combine all of these use cases into one "AI clustering and HPC" application category.100G QSFP28 SR4

Computing clusters in large data centers will be the second largest application of CPO. Some large customers are not going to use proprietary CPO designs, preferring to wait for a new competitive ecosystem based on standard CPO solutions to emerge. This will limit the scale of early deployments, but there will be customers willing to take risks.100G QSFP28 SR4

The figure below shows LC's forecast for CPO ports and pluggable Ethernet optical transceivers and AOC shipments. Pluggable devices will continue to dominate the market for the next five years and beyond. However, CPO ports will account for nearly 30% of the total 800G and 1.6T ports deployed by 2027.100G QSFP28 SR4

CPO supporters may regard this view as too conservative, but LC suspects it may be too optimistic. Forecasters tend to underestimate how long it takes to change an industry's direction.

In this analysis, LC calculates CPO based on 800G and 1.6T transceiver equivalents (or ports), but a CPO engine can combine multiple 800G or 1.6T ports into an opto-chiplet. For example, a single 3.2Tbps engine is equivalent to four 800G CPO ports. Each AOC is calculated as two ports.

LC's current projections do not include shipments of Near Package Optics (NPO) developed by OIF. Meta does plan to use Npos on 51.2T switches, but these are likely to be a limited number of proof-of-concept trials.100G QSFP28 SR4

Will all CPO solutions be based on silicon Photonics (SiP) technology? Probably not. IBM is developing systems based on VCSEL. A start-up company, Avicena, is developing GaN Micro leds to enable extremely low-power, short-range (<10m) connections. More startups are still in stealth mode, and LC says it's looking forward to seeing more technology enter the fray. But at least for now, silicon light is the leader and the ultimate integration platform.100G QSFP28 SR4

Scan the QR code to read on your phone

Related

-

New products | Sunstar announced: 50G PON three-mode combo OLT miniaturized optical device for SFP and QSFP packages

With the popularization of gigabit broadband, 10G PON has entered the stage of large-scale deployment. At the same time, the industry is also laying out 50G PON to prepare for the 10-gigabit era. Compared with 10G PON, the 50G PON standard provides five times more access bandwidth and better service support capabilities (large bandwidth, low latency, and high reliability). At the same time, for operators, the biggest problem facing the commercial use of 50G PON is the problem of multi-generation coexistence. ITU-T standards provide different options for the differentiated deployment of global operators. GPON region, G.9804.1 Amd2 and G.9805 offer 2 classes /5 options; EPON area, provides 2 types /4 options. From this point of view, multi-generation coexistence is an inevitable choice in the continuous evolution of the next generation PON. Sunstar Communication Technology Co.,Ltd.released 50G PON three-mode Combo OLT miniaturized optical device, which is MPM (built-in combined wave) 3-generation wave division mode coexistence, that is, G/XG(S)/50G three-mode MPM. The advantage of this solution is that the traditional gateway devices can be reused without changing or upgrading the user side, and the upgrade process can be optimized, equipment occupation and equipment room space can be saved, and energy consumption can be reduced. This three-mode Combo OLT miniaturized optical device uses a novel optical path design and a miniaturized TO-CAN package solution, and uses the technology accumulation and quality control of Sunstar Company in the field of coaxial packaging for many years, combining precision manufacturing, multi-wavelength spectrographic design and various types of TO-CAN package technology perfectly together. The 50G PON three-mode Combo OLT compact optical device of Sunstar Company is characterized by small size, high coupling efficiency, high structural reliability and strong manufacturability in mass production. The most critical is that its optimized optical path design and special packaging process ensure the upstream three-wavelength splitting, especially the isolation index of 50G PON upstream wavelength and GPON upstream wavelength, that is, the isolation degree of 1286±2nm and 1310±20nm edge wavelength; And take into account the high coupling efficiency of the downgoing three-way emitting laser to ensure the best output optical power index. This optical device is fully suitable for SFP and QSFP module packages, helping the access network to smoothly evolve to 50G PON. The 49th Optical Networking and Communications Symposium and Expo (OFC 2024) will be held from March 26 to 28, 2024 at the San Diego Convention Center, California, USA. The company will bring 10G PON OLT, 25G PON OLT, 50G PON OLT three-mode, 400G ER4 TOSA & ROSA, 800G DR8 optical module and a full range of AOC optical module solutions to the exhibition, welcome to visit the #3841 booth. About Sunstar Founded in 2001, Sunstar Communication Technology Co.,Ltd. focuses on the design, development, manufacturing, sales and technical support services of Optical Transceiver (OSA). After 20 years of technology accumulation and development, the formation of optical path, mechanical structure, high frequency simulation, thermal simulation, circuit, FPC soft board, IT software automation and other core technology design platform, and with precision machining, passive components, SMT, TO-CAN, OSA optical devices, COB, BOX, optical module the whole industry chain production and manufacturing capabilities. The company operates in China, North America, Europe, and Southeast Asia, and is also a subsidiary of the world's leading provider of optical fiber, cable and integrated solutions,YOFC Optical Fiber and Cable Co., LTD. - OFC2024 | Sunstar sincerely invites you to visit #3841 for negotiation and guidance 03-22

- Sunstar Combo 50G & XGS & GPON OLT QSFP-DD light module won the 2023 ICC "Excellent Technology Award" 01-10

- Tel:86-(0)28-87988088

- Fax:86-(0)28-87988568

- Address:West District University, High-tech West Zone, Chengdu City, Sichuan Province Fourth Floor, Building D1, Chengdu Mold Industrial Park, No. 199 Road

Sunstar Communication Technology Co.,Ltd

Copyright © 2020 Sunstar Communication Technology Co.,Ltd All Rights Reserved 蜀ICP备19023203号-1

Scan code

Scan code