IDC cuts forecast for global telecom services revenue growth in 2022 due to economic slowdown

- Categories:Industry News

- Time of issue:2022-05-12

(Summary description)According to IDC's semi-annual Tracking report on global telecom services, global spending on telecom services and pay TV services reached $1,566 billion in 2021, up 1.6 percent year on year. IDC expects global spending on telecoms and pay-TV services to grow 1.4% to $1,588 billion in 2022. In 2021, the global economy recovered rapidly from the downturn caused by the COVID-19 pandemic. This favourable environment has driven additional growth in telecommunications services spending, so that the total value of the global market has grown slightly faster than originally forecast. This trend was shared across all regions of the world: the European, Middle East and Africa (EMEA) market grew 0.2 percentage points faster than forecast in October 2021, asia-pacific grew 0.5 percentage points faster, and the Americas grew 1.0 percentage points faster. Growth was also higher than expected in all technology areas except pay-TV, which is logical because people were able to spend more time outdoors, so some canceled TV packages bought during the lockdown. In its October 2021 report, IDC predicted further recovery (i.e., higher growth rates) in 2022 and 2023. IDC's forecasts have changed, however, due to new developments such as accelerating inflation and a central bank hike in benchmark interest rates that will lead to slower growth in coming years. While the new forecast is still optimistic, IDC expects growth in the first half of this year to be lower than last year. Inflation should have a nominally positive effect on the market: operators will raise rates, customers will pay more, and the total value of the market should grow faster than previously expected. However, inflation also reduces the purchasing power of consumers and businesses, leading to a decline in demand. It is worth noting that the impact of inflation on the telecom services market will expand in the coming years. This is because a large proportion of users have two-year contracts with carriers, which guarantee stable charges until the end of their contracts. But it also means that the impact of inflation is initially higher in markets with a higher proportion of pre-paying customers. The war in Ukraine will have a negative impact on the communication services market in the EMEA region. It will mainly hit the Ukrainian market, which will suffer a sharp decline due to the destruction of network infrastructure and the mass exodus of people from the country. Local demand will come under pressure due to the recession caused by international sanctions and the Russian market will also decline. On the other hand, the war will have a positive impact on the markets of neighbouring countries (Poland, Slovakia and Romania) that host large numbers of Ukrainian refugees. The COVID-19 pandemic is not over yet. The current lockdown in China and the possible emergence of new virus variants in other parts of the world could have an additional impact on the market, mainly in the commercial fixed data services segment. While previous waves of COVID-19 did not have a huge impact on the global telecom services market, related global supply chain disruptions have led to shortages of end users and network equipment, creating new concerns for supply-side players. This is all part of IDC's downward revision. The telecom services industry has remained remarkably stable throughout the COVID-19 pandemic. More than that, it is the backbone of the global economy, allowing people to communicate, play and work from home. "The economic recovery in 2021 is driving growth and leading to higher than expected growth rates, but the same forces that are driving the market up could also be driving the market down," said Kresimir Alic, IDC's global telecom services research director. This market, like any other, is not immune to changing economic trends, and forces like inflation and recession can quickly change the shape of the curve. Inflation has occurred and the economy has started to slow -- so our view on the market remains cautiously positive."

IDC cuts forecast for global telecom services revenue growth in 2022 due to economic slowdown

(Summary description)According to IDC's semi-annual Tracking report on global telecom services, global spending on telecom services and pay TV services reached $1,566 billion in 2021, up 1.6 percent year on year. IDC expects global spending on telecoms and pay-TV services to grow 1.4% to $1,588 billion in 2022.

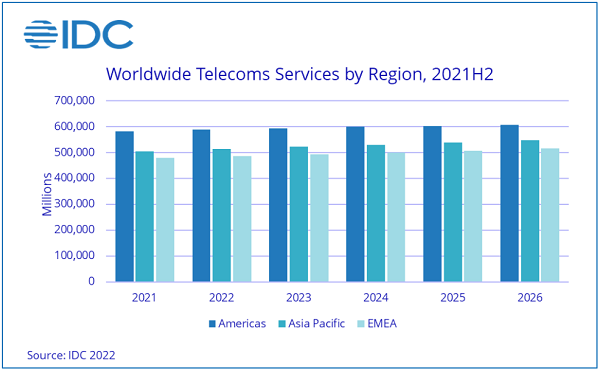

In 2021, the global economy recovered rapidly from the downturn caused by the COVID-19 pandemic. This favourable environment has driven additional growth in telecommunications services spending, so that the total value of the global market has grown slightly faster than originally forecast. This trend was shared across all regions of the world: the European, Middle East and Africa (EMEA) market grew 0.2 percentage points faster than forecast in October 2021, asia-pacific grew 0.5 percentage points faster, and the Americas grew 1.0 percentage points faster. Growth was also higher than expected in all technology areas except pay-TV, which is logical because people were able to spend more time outdoors, so some canceled TV packages bought during the lockdown.

In its October 2021 report, IDC predicted further recovery (i.e., higher growth rates) in 2022 and 2023. IDC's forecasts have changed, however, due to new developments such as accelerating inflation and a central bank hike in benchmark interest rates that will lead to slower growth in coming years. While the new forecast is still optimistic, IDC expects growth in the first half of this year to be lower than last year.

Inflation should have a nominally positive effect on the market: operators will raise rates, customers will pay more, and the total value of the market should grow faster than previously expected. However, inflation also reduces the purchasing power of consumers and businesses, leading to a decline in demand. It is worth noting that the impact of inflation on the telecom services market will expand in the coming years. This is because a large proportion of users have two-year contracts with carriers, which guarantee stable charges until the end of their contracts. But it also means that the impact of inflation is initially higher in markets with a higher proportion of pre-paying customers.

The war in Ukraine will have a negative impact on the communication services market in the EMEA region. It will mainly hit the Ukrainian market, which will suffer a sharp decline due to the destruction of network infrastructure and the mass exodus of people from the country. Local demand will come under pressure due to the recession caused by international sanctions and the Russian market will also decline. On the other hand, the war will have a positive impact on the markets of neighbouring countries (Poland, Slovakia and Romania) that host large numbers of Ukrainian refugees.

The COVID-19 pandemic is not over yet. The current lockdown in China and the possible emergence of new virus variants in other parts of the world could have an additional impact on the market, mainly in the commercial fixed data services segment. While previous waves of COVID-19 did not have a huge impact on the global telecom services market, related global supply chain disruptions have led to shortages of end users and network equipment, creating new concerns for supply-side players. This is all part of IDC's downward revision.

The telecom services industry has remained remarkably stable throughout the COVID-19 pandemic. More than that, it is the backbone of the global economy, allowing people to communicate, play and work from home. "The economic recovery in 2021 is driving growth and leading to higher than expected growth rates, but the same forces that are driving the market up could also be driving the market down," said Kresimir Alic, IDC's global telecom services research director. This market, like any other, is not immune to changing economic trends, and forces like inflation and recession can quickly change the shape of the curve. Inflation has occurred and the economy has started to slow -- so our view on the market remains cautiously positive."

- Categories:Industry News

- Time of issue:2022-05-12

- Views:

According to IDC's semi-annual Tracking report on global telecom services, global spending on telecom services and pay TV services reached $1,566 billion in 2021, up 1.6 percent year on year. IDC expects global spending on telecoms and pay-TV services to grow 1.4% to $1,588 billion in 20222 5G SFP28 Duplex.

In 2021, the global economy recovered rapidly from the downturn caused by the COVID-19 pandemic. This favourable environment has driven additional growth in telecommunications services spending, so that the total value of the global market has grown slightly faster than originally forecast. This trend was shared across all regions of the world: the European, Middle East and Africa (EMEA) market grew 0.2 percentage points faster than forecast in October 2021, asia-pacific grew 0.5 percentage points faster, and the Americas grew 1.0 percentage points faster. Growth was also higher than expected in all technology areas except pay-TV, which is logical because people were able to spend more time outdoors, so some canceled TV packages bought during the lockdown 25G SFP28 Duplex.

In its October 2021 report, IDC predicted further recovery (i.e., higher growth rates) in 2022 and 2023. IDC's forecasts have changed, however, due to new developments such as accelerating inflation and a central bank hike in benchmark interest rates that will lead to slower growth in coming years. While the new forecast is still optimistic, IDC expects growth in the first half of this year to be lower than last year 25G SFP28 Duplex.

Inflation should have a nominally positive effect on the market: operators will raise rates, customers will pay more, and the total value of the market should grow faster than previously expected. However, inflation also reduces the purchasing power of consumers and businesses, leading to a decline in demand. It is worth noting that the impact of inflation on the telecom services market will expand in the coming years. This is because a large proportion of users have two-year contracts with carriers, which guarantee stable charges until the end of their contracts. But it also means that the impact of inflation is initially higher in markets with a higher proportion of pre-paying customers.

The war in Ukraine will have a negative impact on the communication services market in the EMEA region. It will mainly hit the Ukrainian market, which will suffer a sharp decline due to the destruction of network infrastructure and the mass exodus of people from the country. Local demand will come under pressure due to the recession caused by international sanctions and the Russian market will also decline. On the other hand, the war will have a positive impact on the markets of neighbouring countries (Poland, Slovakia and Romania) that host large numbers of Ukrainian refugees 25G SFP28 Duplex.

The COVID-19 pandemic is not over yet. The current lockdown in China and the possible emergence of new virus variants in other parts of the world could have an additional impact on the market, mainly in the commercial fixed data services segment. While previous waves of COVID-19 did not have a huge impact on the global telecom services market, related global supply chain disruptions have led to shortages of end users and network equipment, creating new concerns for supply-side players. This is all part of IDC's downward revision 25G SFP28 Duplex.

The telecom services industry has remained remarkably stable throughout the COVID-19 pandemic. More than that, it is the backbone of the global economy, allowing people to communicate, play and work from home. "The economic recovery in 2021 is driving growth and leading to higher than expected growth rates, but the same forces that are driving the market up could also be driving the market down," said Kresimir Alic, IDC's global telecom services research director. This market, like any other, is not immune to changing economic trends, and forces like inflation and recession can quickly change the shape of the curve. Inflation has occurred and the economy has started to slow -- so our view on the market remains cautiously positive 25G SFP28 Duplex."

Scan the QR code to read on your phone

Related

-

New products | Sunstar announced: 50G PON three-mode combo OLT miniaturized optical device for SFP and QSFP packages

With the popularization of gigabit broadband, 10G PON has entered the stage of large-scale deployment. At the same time, the industry is also laying out 50G PON to prepare for the 10-gigabit era. Compared with 10G PON, the 50G PON standard provides five times more access bandwidth and better service support capabilities (large bandwidth, low latency, and high reliability). At the same time, for operators, the biggest problem facing the commercial use of 50G PON is the problem of multi-generation coexistence. ITU-T standards provide different options for the differentiated deployment of global operators. GPON region, G.9804.1 Amd2 and G.9805 offer 2 classes /5 options; EPON area, provides 2 types /4 options. From this point of view, multi-generation coexistence is an inevitable choice in the continuous evolution of the next generation PON. Sunstar Communication Technology Co.,Ltd.released 50G PON three-mode Combo OLT miniaturized optical device, which is MPM (built-in combined wave) 3-generation wave division mode coexistence, that is, G/XG(S)/50G three-mode MPM. The advantage of this solution is that the traditional gateway devices can be reused without changing or upgrading the user side, and the upgrade process can be optimized, equipment occupation and equipment room space can be saved, and energy consumption can be reduced. This three-mode Combo OLT miniaturized optical device uses a novel optical path design and a miniaturized TO-CAN package solution, and uses the technology accumulation and quality control of Sunstar Company in the field of coaxial packaging for many years, combining precision manufacturing, multi-wavelength spectrographic design and various types of TO-CAN package technology perfectly together. The 50G PON three-mode Combo OLT compact optical device of Sunstar Company is characterized by small size, high coupling efficiency, high structural reliability and strong manufacturability in mass production. The most critical is that its optimized optical path design and special packaging process ensure the upstream three-wavelength splitting, especially the isolation index of 50G PON upstream wavelength and GPON upstream wavelength, that is, the isolation degree of 1286±2nm and 1310±20nm edge wavelength; And take into account the high coupling efficiency of the downgoing three-way emitting laser to ensure the best output optical power index. This optical device is fully suitable for SFP and QSFP module packages, helping the access network to smoothly evolve to 50G PON. The 49th Optical Networking and Communications Symposium and Expo (OFC 2024) will be held from March 26 to 28, 2024 at the San Diego Convention Center, California, USA. The company will bring 10G PON OLT, 25G PON OLT, 50G PON OLT three-mode, 400G ER4 TOSA & ROSA, 800G DR8 optical module and a full range of AOC optical module solutions to the exhibition, welcome to visit the #3841 booth. About Sunstar Founded in 2001, Sunstar Communication Technology Co.,Ltd. focuses on the design, development, manufacturing, sales and technical support services of Optical Transceiver (OSA). After 20 years of technology accumulation and development, the formation of optical path, mechanical structure, high frequency simulation, thermal simulation, circuit, FPC soft board, IT software automation and other core technology design platform, and with precision machining, passive components, SMT, TO-CAN, OSA optical devices, COB, BOX, optical module the whole industry chain production and manufacturing capabilities. The company operates in China, North America, Europe, and Southeast Asia, and is also a subsidiary of the world's leading provider of optical fiber, cable and integrated solutions,YOFC Optical Fiber and Cable Co., LTD. - OFC2024 | Sunstar sincerely invites you to visit #3841 for negotiation and guidance 03-22

- Sunstar Combo 50G & XGS & GPON OLT QSFP-DD light module won the 2023 ICC "Excellent Technology Award" 01-10

- Tel:86-(0)28-87988088

- Fax:86-(0)28-87988568

- Address:4F.,Blog.D1,Mould lndustrial Park West High-tech Zone,Chengdu,Sichuan,P.R.C

Sunstar Communication Technology Co.,Ltd

Copyright © 2020 Sunstar Communication Technology Co.,Ltd All Rights Reserved 蜀ICP备19023203号-1

Scan code

Scan code